Economists Have Warned That the Current Economic Conditions Show Asia Isn’t Always Resilient

Like any other part of the world, Asia faces economic crises. But Asia has always stood out for its ability to bounce back from economic crisis quickly. However, last week in Singapore at the (HICAP) Hotel Investment Conference Asia-Pacific, Arup Raha, a chief economist, said things seem to be going differently this time round.

According to Arup, the financial meltdowns in Asia and globally were caused by China and interest rates. Raha further shared that the US FED has always stabilized the interest rate. But they kept reducing the interest rates during the financial crisis, giving Asian countries the green light to lower interest rates.

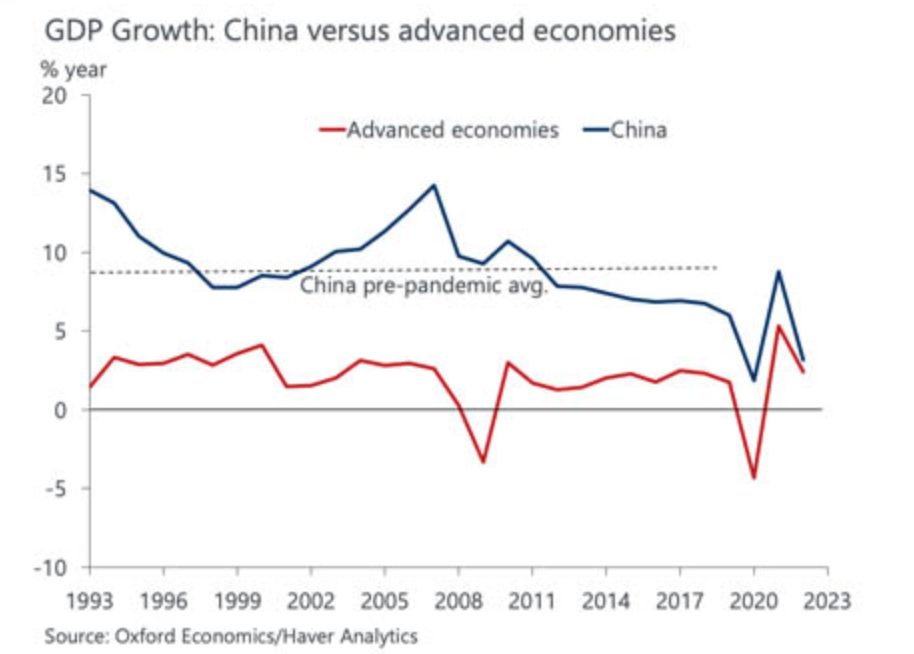

What’s more, Asian countries were always supported by China. Unfortunately, China’s economy fell short of expectations and couldn’t be dependable, with a 0.4% GDP in the second quarter of 2022. Hands down! The worst seen growth rate in China in over 40 years.

China’s Recovery Rate is Pretty Slow

Over the last decade, China has been experiencing a slowdown in its economic growth, according to Raha. The massive economic downturn resulted from COVID-19 and China’s policies.

Currently, a couple of factors could contribute to the recovery of China’s economy. That includes productivity growth, demographics, and shifting from exports to service economies. However, Raha says that despite the recovery, China will no longer be the same.

The hike in energy prices makes it even harder to predict the direction of the Tourism industry. This energy crisis has caused inflation through supply shock. The higher cost of operation in the tourism industry will affect the booking rates. Raha stated that tourism is generally a luxury. So, if anyone is looking to tighten their budget, they are more likely to start by cutting out foreign travel.

A Ray of Sunshine!

Amid all that economic chaos, there’s been a ray of sunshine. Governments have learned how to give proper responses. For instance, Singapore’s government issued two fiscal packages amounting to about 20% of the economy’s GDP. Many people will say the fiscal stimulus from governments over responding was too much.

Raha, on the other hand, thinks it was the right policy. He argued that governments were right to over-respond, especially with the global pandemic’s uncertainty. Otherwise, we would have faced institutional damage. In addition, it helped that governments didn’t rush into tightening policies. For instance, Indonesia only raised its interest rates just recently.

But besides the institutional ability, the environment isn’t conducive. According to the forecast, we should have seen an initial bounce in Asia’s economy as soon as possible, But now the slowdown is here. So, as much as China might pick up the pace, the economy won’t be as strong as it used to be. Thailand might do better. It’s expected that Thailand will get half of 2019’s tourists soon.

On the other hand, the Chinese and Russians face institutional travel constraints. Since the low travel is more institutional than economical, we can’t reasonably predict when it will open up again. Also, we don’t know the kind of structural toll this has taken on the hospitality industry. In Phuket, many hotels and restaurants have closed down their operations.

Everyone Should Brace Themselves for a Hard Landing!

Demand has bounced back post-pandemic, but we can’t say the same for supply. According to ANZ Bank’s senior strategist, Russia’s invasion of Ukraine has strained the commodities market. Traditional energy investments have slumped. On the other hand, Europe and the United Kingdom are facing a living costs crisis.

China is also at risk of inflation. A rebound is far-fetched, with the whole country being forced into lockdown. In addition, property buyers aren’t too happy with the interest rate cuts. With that said, we should prepare for the coming challenging economic conditions. Some challenges will be temporary. However, the supply constraints might last longer due to geopolitical tensions.